Payment Gateway Integration: Step-by-Step Guide

Nowadays, as every business is going live on a digital platform, the use of a payment gateway has increased. Payment gateways offer solutions that enable instant payment, security, credibility for customers and merchants. Merchants install and integrate a payment gateway in their systems to accept payments and provide the best user experience. In this blog, we will learn more about payment gateway, their types, and how to carry out the process of payment gateway integration into your system.

1. What is a Payment Gateway?

A payment gateway is a simple software service that processes credit & debit cards and other types of payment modes for eCommerce businesses in the same way that a POS does for a physical store. Many ecommerce platforms like Magento and Shopify have integrated payment gateways. Any payment processor must make sure that it encrypts online payments and its information to ensure that the debit or credit cards and other payment instruments are well-protected. It must also see that the transaction between the customer and the merchant is successful.

Though this concept seems simple, online payment gateway integration is a bit of a difficult process for any business owner. One of the main reasons for it is the availability of different concepts that aren’t that popular. For instance, the payment processing software must send transaction information for approval to the appropriate source and then have to relay the response back to the merchant store. Only then the store will know that the transaction is approved or denied.

This means that payment gateway is an easy concept but as there are many transaction types, businesses sometimes get confused. So, to make everything clear, we will learn more about payment gateways transaction types and how knowing them can help businesses integrate a payment gateway easily.

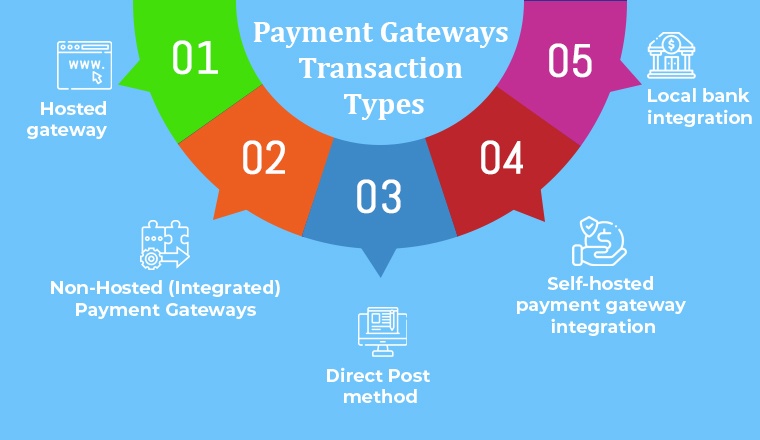

2. Payment Gateways Transaction Types

Some of the most popular payment gateways transaction types used by payment gateway services providers are also how you can integrate into your business system. –

1. Hosted Gateway

A hosted payment gateway is a third-party solution that takes users on their platform to initiate and complete the payment process. This means that when your customers want to make a payment for the products they have bought from your business site, they have to leave your company’s website to complete a purchase. Basically, the customer is redirected to a payment gateway page and their customer has to enter his credit card or debit card details. After the transaction data is sent, the client is redirected back to the business owner’s website.

Pros of Hosted Gateway

All the payment processing is taken care of by the payment solution providers. Vendor saves clients card details. This means that using a hosted gateway doesn’t require PCI compliance.

Cons of Hosted Gateway

Hosted gateways don’t offer full control over the payment process to the business owner. The customers might not trust third-party payment solutions but will have to use them anyway.

Process of Hosted Payment Gateway

Hosted payment gateways follow a simple process in which it will take a client off from the merchant’s site checkout page. After the user taps on a pay button on the eCommerce website, the system redirects the client to the payment service offering page. On the page of the payment service provider, the user will have to fill in his payment details and after that, the payment will be done. Once the amount is paid, the system will redirect him again back to the merchant’s website to complete the checkout process.

Besides this, there is one more option that comes with using an iframe. The PSP (payment service provider) creates a form named iframe. This form is inserted in the business owner’s website. By this, the merchant can accept debit and credit cards transactions without storing card information on their business website. All the user’s payment information is gathered with the use of an inline frame (iframe). This form is hosted by the payment service provider and this means when the clients fill the form, the data is received by the PSP.

In addition to this, when it comes to recurring payments, the user’s profile is created with the information of recurrence frequency, count, amount, and more. The payment gateway used by the merchant deducts recurring payments and this is all possible because of the profile created on it. The user receives a payment notification from the PSP to the website. The cancellation or refund of the payment is done with the help of payment gateway sites.

Top Hosted Gateways Available in the Market

- PayPal

- Amazon Pay

- Stripe

- SagePay

2. Non-Hosted Payment Gateways

A non-hosted or integrated payment gateway has no third parties involved in the payment checkout process. The firms that use integrated gateways have PCI DSS compliance and this means that they are completely in charge of securing, storing, and conducting initial verification for all the transactions that happen. This process is done by installing and integrating the custom payment gateway solution on the merchant’s website.

Some companies use a white label payment gateway and this means that they get a prebuilt gateway that can be branded and customized as per their needs. Besides this, an integrated (non-hosted) gateway can be a committed source of revenue.

Pros of Non-Hosted Gateways

They offer full control over the transactions to the business owners on their websites. Businesses can even customize the payment system as they wish.

Cons of Non-Hosted Gateways

Non-hosted gateways are all about maintaining the infrastructure and this increases the expenses.

Process of Non-Hosted Payment Gateway

There are merchants in the market who want to have full control over the checkout process and don’t want their clients to be directed away from their website’s checkout page. In this case, they go with a non-hosted gateway and this means that their system enables the clients to enter their debit or credit card details on the website’s checkout page and make the payment using APIs or HTTPS queries. This is a type of gateway that supports both recurring and fixed recurring payments.

Top Non-Hosted Gateways Available in the Market

- Authorize.Net

- MangoPay

- SagePay Direct Integration

3. Direct Post Method

Direct Post is an approach where businesses integrate a payment gateway that enables a customer to shop without leaving the site. In this method, the system assumes that the payment information will be posted to the payment gateway once the client clicks the purchase button on the site. The purchase data and the payment details are instantly sent to the gateway and without being stored on the business owner’s server.

Pros of Direct Post Method

It is equal to an integrated payment gateway which means that any business owner can customize it without PCI DSS compliance.

Cons of the Direct Post Method

The only disadvantage of the direct post method is that it isn’t completely secure.

Process of Direct Post Method Gateway

In the market, you will also find a payment processor that doesn’t support instant payment notifications. Such payment processors need to create a user’s profile and deduct the necessary amount from the user’s card as per the schedule. But it doesn’t inform the system about the person or institution who requested the amount. The processors only inform whether the card is rejected or approved. And in this case, the system requires to make an inquiry frequently to the payment processor and check if the payment is received or not.

Top Direct Post Method Gateways Available in the Market

- Payflow Pro

4. Self-Hosted Payment Gateway Integration

A self-hosted payment gateway is something where the payment details are gathered from the client inside the business website. And once the client details are requested, the collected information is forwarded to the payment gateway’s URL. There are some gateways that require the payment information in a specific format, but others just need a hash key or secret key.

Pros of Self-hosted Payment Gateway

This approach offers good customer experiences. The entire transaction status is finished in one place. Besides, the business can control the entire payment method by customizing the payment gateway.

Cons of Self-hosted Payment Gateway

The self-hosted payment gateways usually do not have any kind of technical support team. So, when the system fails, the payment gateway provider will have to figure out the problem by himself or hire a professional to offer the best services to the end-users. And this can be costly.

Process of Self-hosted Payment Gateway

When merchants are using self-hosted payment gateways, they have to ask the payment details from website users. After merchants get the users’ details, they will have to send the gathered data to the URL of the Payment Gateway.

Top Self-Hosted Payment Gateway Integration Available in the Market

- Authorized.Net ARB

- PayPal Website Payment Pro

5. Local Bank Integration

Local bank integration payment processor is an approach that the merchants who offer online payment services like to use. This approach redirects the customer to the bank’s website (payment gateway’s website)where the clients will have to enter their contact details and payment information. Once the payment is cleared, the client will be redirected back to the merchant’s website and he will be notified about the payment.

Pros of Local Bank Integration

It is an easy to set up and quick to understand payment gateway that works the best for small businesses that want to have a simple one-time online payment structure.

Cons of Local Bank Integration

It only offers some basic features and they usually don’t enable recurring payments. This makes it not so ideal for wholesalers.

Process of Local Bank Integration Payment Gateway

Local bank integration payment gateways are also treated as hosted payment gateways and it works in a straightforward manner. The merchants who use this type of gateway, their sites redirect the users to the payment gateway’s website and this is where the user will have to fill in the contact details and payment details. Once the payment is done, the user is redirected back to the merchant’s site and is notified along with the redirection process. This is a type of payment gateway that doesn’t support recurring payments, cancellations, and refunds. Merchants need to complete all of these.

Top Local Bank Integration Available in the Market

- Payseal

- Bank Audi

3. Conclusion

As seen in this blog, there are many payment gateway solutions available in the market. Businesses can choose the right payment gateway and can integrate online payment gateway to enhance user experience and offer maximum security to the clients. There are many different payment gateways that come with security measures like two-factor authentication, TLS encryption, and PCI-DSS compliance. Being a business owner you can choose any highly-secured payment gateway and integrate it without complications.

Hardik Dhanani has a strong technical proficiency and domain expertise which comes by managing multiple development projects of clients from different demographics. Hardik helps clients gain added-advantage over compliance and technological trends. He is one of the core members of the technical analysis team.

Payment gateways bridge the gap between a customer and a merchant. It enables the customer to make an online payment with ease and ensures that...

Feb 7, 2022

Feb 7, 2022

Comments

Leave a message...